22th December 2014 – Last Friday Standard Ethics announced the first independent evaluation on Euro Corporate Green Bonds.

The results released by Standard Ethics show that only 65% of the green bonds are above adequate levels of international compliance and no issuance has received the highest ratings. However, Standard Ethics believes that a growing market of these bonds will require issuers to further increase their standards and apply for independent evaluations.

The Rating is an opinion on the level of compliance with sustainability and corporate social responsibility (CSR) on the basis of documents and guidelines published by: the European Union (EU); the Organisation for Economic Cooperation and Development (OECD); the United Nations (UN).

Standard Ethics, to better formulate a second opinion on Green Bonds, has decided to integrate its proprietary rating and ESG model with the guidelines recommended by the ICMA’s Green Bonds Prin-ciple (International Capital Market Association).

The evaluation scheme is based on 5 main elements of analysis concerning the consistency of the project to “green policies”:

- Use of proceeds;

- Management of proceeds;

- Assurance and quality of the second opinion;

- Quality of the Corporate Bond issue;

- Investor reporting and auditing.

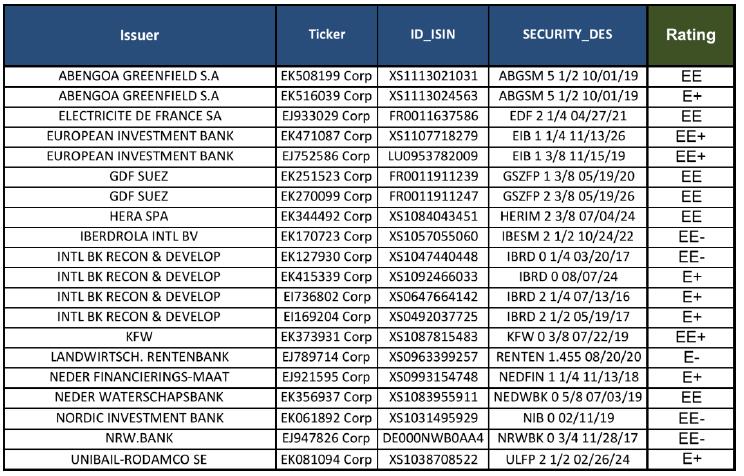

List of Green Bonds ratings